Protect yourself and your tenants with renters insurance

Identify reliable tenants and help them safeguard their belongings. Easily request and verify their proof of coverage.

Gain peace of mind

Tenants willing to purchase insurance take better care of their belongings and the place they live, demonstrating their reliability.

Reduce risk

Tenants can safeguard their personal property and liability, preventing the burden from falling on you in the event of damage, loss, or injury.

Avoid unexpected costs

If your property becomes unlivable due to a fire or natural disaster, renters insurance will help cover relocation costs for your tenant.

Request proof of coverage in 3 easy steps

1.

Select your property

Choose the property where you’d like to request renters insurance.

2.

Send a notice to your tenant

Notify your tenant that they are required to obtain renters insurance in one click. They can either upload proof of an active policy, or easily purchase one through our partnership with Sure.

3.

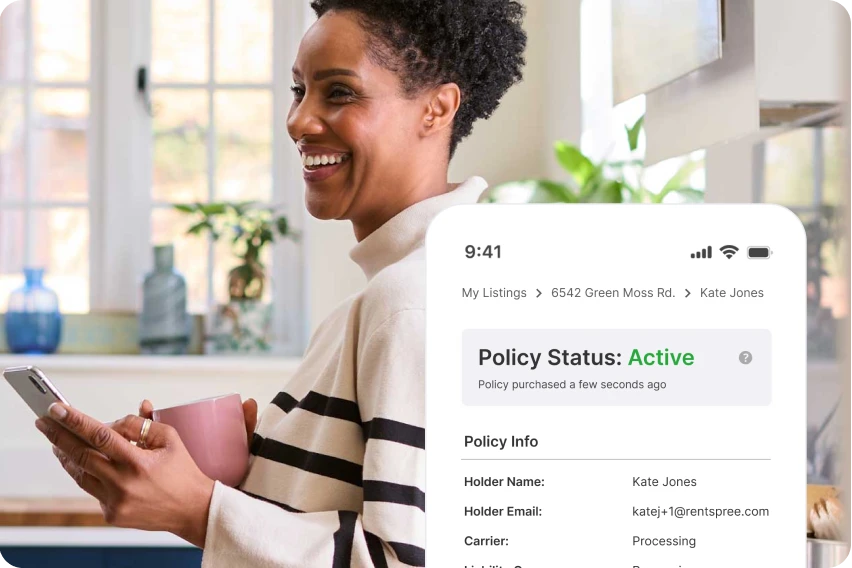

Get a confirmation

You'll receive an email once your tenants have shared proof of insurance. Their policy details will be available to view on your RentSpree dashboard.

Additional tools to streamline your rental process

Tenant Screening

Get comprehensive information on your prospective tenants.

Accept/Deny

Easily send approvals and adverse action letters to applicants.

Rent Payment

Collect security deposits, recurring monthly rent, and other one-time fees.

Frequently asked questions

Although not required by state law, a standard renters insurance policy is the only way your tenants can protect their belongings, because your rental property insurance won’t cover their personal property. It can also protect a renter from having to pay out of pocket for other common incidents like water backup damage and certain natural disasters, which helps you protect your investment.

Rental insurance for an investment property will vary, but policies will generally cover the dwelling or structure of your property, contents of the property belonging to the landlord, liability coverage and loss of rental income. Much of its coverage is similar to that of homeowners insurance, though it has unique features that homeowners insurance lacks and which account for the added risk of having tenants on your property.

No. The best landlord insurance covers the property that is used to service the rental property, while renters insurance covers the property owned by the tenant.

There are two clear differences between rental property insurance and renters insurance. For landlords, rental property insurance protects the property owner against damages not caused by the tenant. Renters insurance covers the need to replace damaged items that belong to the tenant. If your tenant's apartment is damaged by natural causes or if your unit is burglarized, the tenant can claim reimbursement on the actual cash value of the items damaged or stolen.

Renters insurance is usually an inexpensive way to protect a tenant's personal belongings against things that are outside their control.